Collar Hedge Example . A collar option strategy, or simply collar, is a trading strategy that involves buying a protective put. the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. the collar is an options trading strategy that limits profits and losses. a collar option strategy is an options strategy that limits both gains and losses. what is a collar options strategy? A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option. Learn how dynamic options collar strategies can potentially help build. options collars offer stock hedges with reasonable upsides.

from optionstradingiq.com

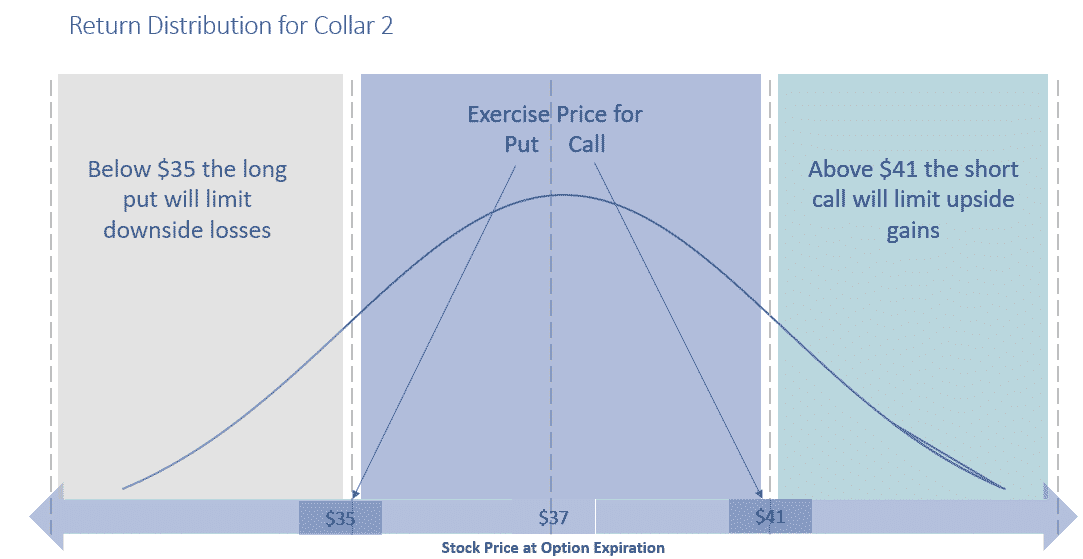

what is a collar options strategy? a collar option strategy is an options strategy that limits both gains and losses. the collar is an options trading strategy that limits profits and losses. Learn how dynamic options collar strategies can potentially help build. A collar option strategy, or simply collar, is a trading strategy that involves buying a protective put. the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option. options collars offer stock hedges with reasonable upsides.

The Ultimate Guide To The Collar Strategy

Collar Hedge Example a collar option strategy is an options strategy that limits both gains and losses. the collar is an options trading strategy that limits profits and losses. Learn how dynamic options collar strategies can potentially help build. the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. A collar option strategy, or simply collar, is a trading strategy that involves buying a protective put. what is a collar options strategy? a collar option strategy is an options strategy that limits both gains and losses. options collars offer stock hedges with reasonable upsides. A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option.

From www.tradingview.com

Cardwell Style RSI / 3 Way Collar Hedge / Middleton Theory Draft for Collar Hedge Example what is a collar options strategy? the collar is an options trading strategy that limits profits and losses. the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. a collar option strategy is an options strategy that limits both gains and losses. A collar option strategy, or. Collar Hedge Example.

From dxojjvpvk.blob.core.windows.net

How To Price A Collar at Jeffrey Barksdale blog Collar Hedge Example A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option. a collar option strategy is an options strategy that limits both gains and losses. what is a collar options strategy? Learn how dynamic options collar strategies can potentially help build. A. Collar Hedge Example.

From www.lme.com

Physical and financial hedging beginners guide London Metal Exchange Collar Hedge Example A collar option strategy, or simply collar, is a trading strategy that involves buying a protective put. the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. Learn how dynamic options collar strategies can potentially help build. the collar is an options trading strategy that limits profits and losses.. Collar Hedge Example.

From aegis-hedging.com

Hedging Strategy Toolkit Bull Market Aegis Market Insights Collar Hedge Example options collars offer stock hedges with reasonable upsides. the collar is an options trading strategy that limits profits and losses. the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. Learn how dynamic options collar strategies can potentially help build. a collar option strategy is an options. Collar Hedge Example.

From dengarden.com

The 8 Best Hedge Plants Dengarden Collar Hedge Example the collar is an options trading strategy that limits profits and losses. what is a collar options strategy? the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. options collars offer stock hedges with reasonable upsides. Learn how dynamic options collar strategies can potentially help build. . Collar Hedge Example.

From www.slideserve.com

PPT Hedging PowerPoint Presentation, free download ID3400534 Collar Hedge Example Learn how dynamic options collar strategies can potentially help build. what is a collar options strategy? A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option. the collar is an options trading strategy that limits profits and losses. the collar. Collar Hedge Example.

From www.cmegroup.com

Hedging with WTI Crude Oil Weekly Options CME Group Collar Hedge Example A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option. options collars offer stock hedges with reasonable upsides. Learn how dynamic options collar strategies can potentially help build. the collar is an options trading strategy that limits profits and losses. A. Collar Hedge Example.

From www.homeimprovementpages.com.au

5 of the best hedges for creating privacy Collar Hedge Example options collars offer stock hedges with reasonable upsides. the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option. Learn how dynamic options. Collar Hedge Example.

From www.alt21.com

Collar ALT21 Hedging for Everyone Collar Hedge Example the collar is an options trading strategy that limits profits and losses. a collar option strategy is an options strategy that limits both gains and losses. options collars offer stock hedges with reasonable upsides. what is a collar options strategy? the collar strategy is an option strategy that allows the investor to acquire downside protection. Collar Hedge Example.

From www.chegg.com

Solved Q3. Collar hedging Underlying at 100 and options have Collar Hedge Example A collar option strategy, or simply collar, is a trading strategy that involves buying a protective put. options collars offer stock hedges with reasonable upsides. A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option. what is a collar options strategy?. Collar Hedge Example.

From www.cmegroup.com

Hedging with Ag Weekly Options CME Group Collar Hedge Example A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option. options collars offer stock hedges with reasonable upsides. Learn how dynamic options collar strategies can potentially help build. a collar option strategy is an options strategy that limits both gains and. Collar Hedge Example.

From www.slideserve.com

PPT Risk Management Oil & Gas PowerPoint Presentation, free Collar Hedge Example A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option. A collar option strategy, or simply collar, is a trading strategy that involves buying a protective put. the collar strategy is an option strategy that allows the investor to acquire downside protection. Collar Hedge Example.

From www.youtube.com

Institutional Hedging Strategy The Options Collar YouTube Collar Hedge Example the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. the collar is an options trading strategy that limits profits and losses. A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option.. Collar Hedge Example.

From www.youtube.com

Mastering the Art of Hedging PROTECTIVE COLLAR Option Trading Collar Hedge Example options collars offer stock hedges with reasonable upsides. A collar position is created by holding an underlying stock, buying an out of the money put option, and selling an out of the money call option. the collar is an options trading strategy that limits profits and losses. a collar option strategy is an options strategy that limits. Collar Hedge Example.

From redot.com

Collar Options Strategy Beginners Trading Guide Redot Blog Collar Hedge Example a collar option strategy is an options strategy that limits both gains and losses. the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. Learn how dynamic options collar strategies can potentially help build. the collar is an options trading strategy that limits profits and losses. A collar. Collar Hedge Example.

From finance.gov.capital

What is the purpose of a collar strategy in hedging? Finance.Gov.Capital Collar Hedge Example what is a collar options strategy? a collar option strategy is an options strategy that limits both gains and losses. Learn how dynamic options collar strategies can potentially help build. the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. the collar is an options trading strategy. Collar Hedge Example.

From hedgenewyork.com

Vintage Lace Pointed Collar HEDGE Collar Hedge Example a collar option strategy is an options strategy that limits both gains and losses. options collars offer stock hedges with reasonable upsides. the collar is an options trading strategy that limits profits and losses. Learn how dynamic options collar strategies can potentially help build. A collar option strategy, or simply collar, is a trading strategy that involves. Collar Hedge Example.

From www.youtube.com

Interest Rate Collars Collar Hedge ACCA AFM Luqman Rafiq Collar Hedge Example the collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside. what is a collar options strategy? Learn how dynamic options collar strategies can potentially help build. a collar option strategy is an options strategy that limits both gains and losses. A collar option strategy, or simply collar, is. Collar Hedge Example.